Thursday, December 17, 2009

Thursday, December 10, 2009

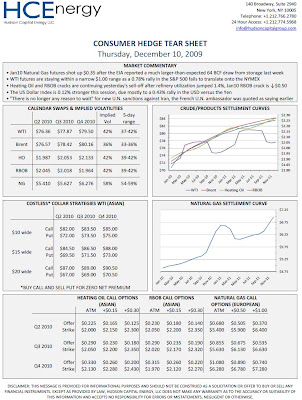

Consumer Hedge Tear Sheet: Dec 10

HCEnergy produces a Consumer Hedge Tear Sheet which is distributed 2-3 times per week to our clients. Please contact info@hudsoncapitalgroup.com if you would like to be added to the e-mail distribution list.

Monday, November 23, 2009

Wednesday, November 18, 2009

Trader's Commentary

While demand remains lackluster downstream, crude markets remain firm around the $80 mark despite rising inventories in WTI. Implied volatility has dropped in line. Recall there is incentive to increase inventories in Oklahoma for year end tax purposes, so beware the builds in Cushing. Physical markets in refined products have not been helped by warmer weather and a slow economic recovery. It is also notable that NG suffered a 27 cent down day based on reversing weather calls from yesterday.

Heating oil traders and suppliers taking on inventory with low demand may look to hedge with collars or put spreads in this market. The Dec-March calendar heating oil swap is priced at $2.12 per gallon.

180 – 200 put spread is now 6 cents or sell the 230 call.

Zero cost collar (hedger buys put) is 200 put versus 220 call.

Please call for further detail.

Heating oil traders and suppliers taking on inventory with low demand may look to hedge with collars or put spreads in this market. The Dec-March calendar heating oil swap is priced at $2.12 per gallon.

180 – 200 put spread is now 6 cents or sell the 230 call.

Zero cost collar (hedger buys put) is 200 put versus 220 call.

Please call for further detail.

Monday, November 16, 2009

Platts: Singapore Airlines strips down fuel hedge

Singapore Airlines strips down fuel hedge

Carrier takes gamble on prices holding steady for next 6 months

Singapore—Singapore Airlines has overhauled and stripped down its jet fuel hedging policy to leave itself deliberately more exposed in the jet fuel market, in a gamble that actual fuel prices will hold steady for the next six months, senior company executives told analysts in Singapore this week.

The airline, which is well known for running one of the most transparent hedging programs in the world, has dramatically scaled back from a position that in recent years covered as much as 60% of the jet fuel it consumes. Singapore Airlines currently holds 3.52 million barrels of jet fuel hedges at an average price of $100/barrel out until March 2010. The hedges are enough to cover 22% of the 16 million barrels the airline expects to consume in the six months up to then. The position is well below the minimum

30% protection Singapore Airlines once required. Chief Executive Officer Chew Choon Seng said the board of Singapore Airlines had pushed back on taking bigger hedges after the extreme volatility in fuel prices of the past year.

“We—when I say we I mean not just the management but the board committee that oversees our hedging activities—had to review the policy in the light of the substantial losses that were incurred when oil and fuel took a precipitous drop,” said Chew. “The magnitude of the volatility forced us to re-examine the wisdom of adhering to the previously laid-down policy. And I suppose our counter-parties in hedging did the same too, because their pricing on hedging instruments corrected very sharply.”

Chew’s comments suggest that the premiums charged for call options close to prevailing market values have simply become too expensive for the airline, especially since it has sworn off the very risky strategy of covering some of those costs through the sale of put options to other companies. Singapore Airlines has steered away from taking outright positions in the swaps markets, or dealing in risky collar option structures. It has opted instead for straightforward call options, which can be costly when volatility is high.

Call options give holders the right to buy protection in the shape of cheaply priced derivatives after a major market rally. They are usually bought with strike prices above prevailing levels, as an insurance policy against a spike.

“I suppose it reflects the underlying volatility,” Chew said of the increasingly expensive call options on offer. “And as a result of which the prices that we were getting on the market were not worth the risks that were being covered, and hence we decided to trim the level of our exposure.”

A massive loss from its hedges in the last six months forced the airline to take a step back from hedging in general. The Singapore Airlines group as a whole lost almost half a billion Singapore dollars in the six months ended September 30. The parent company lost S$400 million ($289 million) from its hedges, while its cargo company lost another S$70 million, and its budget airline SilkAir lost a further S$16 million.

Much of those losses would have been offset by lower fuel bills in the physical jet fuel market. Jet fuel costs have made up 36% of Singapore Airlines’ expenses so far this financial year, and the company’s decision to turn its back on its previous, well-defined hedging strategy prompted questions from analysts— particularly about its assumption that jet fuel prices should hold steady for some time to come.

“I appreciate that you do believe that fuel prices will stay at the current levels, but obviously a hedging strategy is to hedge against the risk that we’re wrong, so why have you taken a slightly different approach than you’ve taken previously,” asked HSBC bank analyst Mark Webb. Chew defended Singapore Airlines’ decision to effectively take the risk that oil prices will not rise much from current levels. “The fact of the matter is that the fundamentals of the global economy are not that rosy, but markets seem to be riding ahead on high liquidity. Whether that’s sustainable remains to be seen,” he said. Chew added that the airline noted with interest that Saudi Arabia in particular was hoping to maintain oil prices at current levels, and avoid any further gains.

“But at the end of the day markets have minds of their own, and so...you place your money and you take your pick,” Chew acknowledged. The company has cut hedges to minimal levels in a bid to slash reported derivatives losses on its books by the end of the year. At current prices, its remaining hedges would generate a S$50 million loss in the next six months, much less than the red ink it suffered in the last six months. The decision could ultimately be looked on by shareholders with hindsight as wise or foolish. Singapore Airlines acknowledged that a big rally in oil prices would now be worse for business than usual.

“Of course, if jet fuel prices go above $100 or go near $100, then hedging losses will be less. But conversely, our fuel expenditure will go up, and we certainly hope that will not be the case, because being hedged only 22%, it leaves 78% naked,” said Chew. Physical jet fuel prices closed in Singapore November 12 at $85.22/barrel, down 37 cents/b on the day but up $2.44/b since the start of the month.—Dave Ernsberger

Carrier takes gamble on prices holding steady for next 6 months

Singapore—Singapore Airlines has overhauled and stripped down its jet fuel hedging policy to leave itself deliberately more exposed in the jet fuel market, in a gamble that actual fuel prices will hold steady for the next six months, senior company executives told analysts in Singapore this week.

The airline, which is well known for running one of the most transparent hedging programs in the world, has dramatically scaled back from a position that in recent years covered as much as 60% of the jet fuel it consumes. Singapore Airlines currently holds 3.52 million barrels of jet fuel hedges at an average price of $100/barrel out until March 2010. The hedges are enough to cover 22% of the 16 million barrels the airline expects to consume in the six months up to then. The position is well below the minimum

30% protection Singapore Airlines once required. Chief Executive Officer Chew Choon Seng said the board of Singapore Airlines had pushed back on taking bigger hedges after the extreme volatility in fuel prices of the past year.

“We—when I say we I mean not just the management but the board committee that oversees our hedging activities—had to review the policy in the light of the substantial losses that were incurred when oil and fuel took a precipitous drop,” said Chew. “The magnitude of the volatility forced us to re-examine the wisdom of adhering to the previously laid-down policy. And I suppose our counter-parties in hedging did the same too, because their pricing on hedging instruments corrected very sharply.”

Chew’s comments suggest that the premiums charged for call options close to prevailing market values have simply become too expensive for the airline, especially since it has sworn off the very risky strategy of covering some of those costs through the sale of put options to other companies. Singapore Airlines has steered away from taking outright positions in the swaps markets, or dealing in risky collar option structures. It has opted instead for straightforward call options, which can be costly when volatility is high.

Call options give holders the right to buy protection in the shape of cheaply priced derivatives after a major market rally. They are usually bought with strike prices above prevailing levels, as an insurance policy against a spike.

“I suppose it reflects the underlying volatility,” Chew said of the increasingly expensive call options on offer. “And as a result of which the prices that we were getting on the market were not worth the risks that were being covered, and hence we decided to trim the level of our exposure.”

A massive loss from its hedges in the last six months forced the airline to take a step back from hedging in general. The Singapore Airlines group as a whole lost almost half a billion Singapore dollars in the six months ended September 30. The parent company lost S$400 million ($289 million) from its hedges, while its cargo company lost another S$70 million, and its budget airline SilkAir lost a further S$16 million.

Much of those losses would have been offset by lower fuel bills in the physical jet fuel market. Jet fuel costs have made up 36% of Singapore Airlines’ expenses so far this financial year, and the company’s decision to turn its back on its previous, well-defined hedging strategy prompted questions from analysts— particularly about its assumption that jet fuel prices should hold steady for some time to come.

“I appreciate that you do believe that fuel prices will stay at the current levels, but obviously a hedging strategy is to hedge against the risk that we’re wrong, so why have you taken a slightly different approach than you’ve taken previously,” asked HSBC bank analyst Mark Webb. Chew defended Singapore Airlines’ decision to effectively take the risk that oil prices will not rise much from current levels. “The fact of the matter is that the fundamentals of the global economy are not that rosy, but markets seem to be riding ahead on high liquidity. Whether that’s sustainable remains to be seen,” he said. Chew added that the airline noted with interest that Saudi Arabia in particular was hoping to maintain oil prices at current levels, and avoid any further gains.

“But at the end of the day markets have minds of their own, and so...you place your money and you take your pick,” Chew acknowledged. The company has cut hedges to minimal levels in a bid to slash reported derivatives losses on its books by the end of the year. At current prices, its remaining hedges would generate a S$50 million loss in the next six months, much less than the red ink it suffered in the last six months. The decision could ultimately be looked on by shareholders with hindsight as wise or foolish. Singapore Airlines acknowledged that a big rally in oil prices would now be worse for business than usual.

“Of course, if jet fuel prices go above $100 or go near $100, then hedging losses will be less. But conversely, our fuel expenditure will go up, and we certainly hope that will not be the case, because being hedged only 22%, it leaves 78% naked,” said Chew. Physical jet fuel prices closed in Singapore November 12 at $85.22/barrel, down 37 cents/b on the day but up $2.44/b since the start of the month.—Dave Ernsberger

Thursday, November 12, 2009

Senate Committee on Banking: Discussion Draft of Financial Regulatory Reform

Senator Dodd (D-Conn) and 8 other Democratic members of the Senate Committee on Banking released an approximately 1,200 page draft proposal for financial regulatory reform yesterday.

All commodity swaps and options subject to US law are required to be submitted for clearing, with two exceptions:

A discussion draft summary is available at http://banking.senate.gov/public/_files/FinancialReformDiscussionDraft111009.pdf while the full discussion draft text is available at http://banking.senate.gov/public/_files/AYO09D44_xml.pdf.

All commodity swaps and options subject to US law are required to be submitted for clearing, with two exceptions:

- No clearing organization will accept the swap or option for clearing

- One of the parties to a trade is not a swap dealer or major swap participant AND is ineligible to use a clearing organization

A discussion draft summary is available at http://banking.senate.gov/public/_files/FinancialReformDiscussionDraft111009.pdf while the full discussion draft text is available at http://banking.senate.gov/public/_files/AYO09D44_xml.pdf.

Monday, November 9, 2009

Thursday, November 5, 2009

Wednesday, November 4, 2009

Tuesday, November 3, 2009

Wednesday, October 28, 2009

Tuesday, October 27, 2009

CFTC Chairman Gensler's remarks to the Natural Gas Roundtable Luncheon

CFTC Chairman Gary Gensler delivered remarks at the Natural Gas Roundtable Luncheon earlier today. He summarized the current regulatory reform proposals pending in the U.S. House of Representatives by saying the following:

The full text of his remarks is available at: http://www.cftc.gov/ucm/groups/public/@newsroom/documents/speechandtestimony/opagensler-16.pdf

Both of the committees’ bills include three important elements of regulatory reform: First, they require swap dealers and major swap participants to register and come under comprehensive regulation. This includes capital standards, margin requirements, business conduct standards and recordkeeping and reporting requirements. Second, the bills require that dealers and major swap participants bring their clearable swaps into central clearinghouses. Third, they require dealers and major swap participants to use transparent trading venues for their clearable swaps and provide the CFTC with authority to impose position limits in the OTC derivatives markets.

The full text of his remarks is available at: http://www.cftc.gov/ucm/groups/public/@newsroom/documents/speechandtestimony/opagensler-16.pdf

Wednesday, October 21, 2009

Tuesday, October 20, 2009

Friday, October 16, 2009

Market Commentary

Energies finished on the highs this week, following a week of bullish stats and a weakening USD. Refinery runs were particularly bullish for products with surprise RB draw of 5.1 MN bbls and a 4% decrease in capacity utilization. We note however that distillate inventories remain at decade highs and global mid distillate inventories remain high across the board. This likely keeps refining margins under pressure for some time to come.

The other big story of the week was the falling volatility in crude options. In a rising market, we often see volatility decrease. This was not the case last week when it was rumored that a larger player was buying longer-dated positions and keeping the options market firm. In the absence of this buyer, volatility trimmed 7% this week with a slight increase to the call skew. With this in mind, we suggest that short hedgers buy puts as an alternative to short futures strategies.

Examples: November WTI Asian $75.00 put is $2.00, OR consider the costless $75.00 put vs the $82.50 Call as a collar.

Natural gas note: Fundamentals remain bearish despite some near term cold. The Friday rally was another reminder of the unpredictability of the NG market. Despite the rally, the Nov-Dec spread went out to -$0.936, a bearish indication.

The other big story of the week was the falling volatility in crude options. In a rising market, we often see volatility decrease. This was not the case last week when it was rumored that a larger player was buying longer-dated positions and keeping the options market firm. In the absence of this buyer, volatility trimmed 7% this week with a slight increase to the call skew. With this in mind, we suggest that short hedgers buy puts as an alternative to short futures strategies.

Examples: November WTI Asian $75.00 put is $2.00, OR consider the costless $75.00 put vs the $82.50 Call as a collar.

Natural gas note: Fundamentals remain bearish despite some near term cold. The Friday rally was another reminder of the unpredictability of the NG market. Despite the rally, the Nov-Dec spread went out to -$0.936, a bearish indication.

Thursday, October 15, 2009

Tuesday, October 13, 2009

Monday, October 12, 2009

Effect of Columbus Day bank holiday on U.S. Energy Markets

Due to the Columbus Day bank holiday API statistics will be released on Wednesday, October 14th (4:30 PM EDT) while DOE statistics for petroleum and natural gas will be released on Thursday, October 15th (10:30 AM EDT for natural gas, 11:00 AM EDT for petroleum). NYMEX markets are operating normally today.

Thursday, October 8, 2009

Tuesday, October 6, 2009

Monday, October 5, 2009

Wednesday, September 30, 2009

Market Update: End of Third Quarter

DOE Inventory Statistics (in millions of barrels): Crude +2.8, Distillate +0.3, Gasoline -1.6, Refinery utilization -1.0%, Cushing -1.6

A big rally today in crude followed statistics that were in-line with expectations, aside from refined products which had smaller-than-expected builds. Heat and RB cracks seem to have hit some key support levels where economics are thin for refiners collectively in the US. Consequently, crack spreads improved by $0.50/bbl. Technical analysts saw key levels broken in crude which drove it much higher than we expected. The average investors/funds were neutral but we believe index investors needed to increase positions going into Q3.

At this point, we again caution against short swaps or short futures positions even though we would be looking for a pull back Thursday and Friday. Otherwise, short futures with a call stop loss strategy. The December $80 call is worth $1.60/bbl. That does not look too expensive against the backdrop of a weak USD and Iran risk.

For those covering inventory, the October $62-67 Asian crude put spread works nicely for $1/bbl. If you have room to sell upside, use the $73.5 call to create a zero cost 3-way.

Regarding regulatory reform efforts, the SEC and CFTC are jointly reviewing how to harmonize their approaches to market regulation and are expected to publish a report on October 15th. One of the points that will be studied is "National market and common clearing versus separate markets and exchange-directed clearing."

Sources: EIA (http://www.eia.doe.gov/oil_gas/petroleum/data_publications/weekly_petroleum_status_report/wpsr.html), SEC (http://www.sec.gov/news/press/2009/2009-211.htm)

A big rally today in crude followed statistics that were in-line with expectations, aside from refined products which had smaller-than-expected builds. Heat and RB cracks seem to have hit some key support levels where economics are thin for refiners collectively in the US. Consequently, crack spreads improved by $0.50/bbl. Technical analysts saw key levels broken in crude which drove it much higher than we expected. The average investors/funds were neutral but we believe index investors needed to increase positions going into Q3.

At this point, we again caution against short swaps or short futures positions even though we would be looking for a pull back Thursday and Friday. Otherwise, short futures with a call stop loss strategy. The December $80 call is worth $1.60/bbl. That does not look too expensive against the backdrop of a weak USD and Iran risk.

For those covering inventory, the October $62-67 Asian crude put spread works nicely for $1/bbl. If you have room to sell upside, use the $73.5 call to create a zero cost 3-way.

Regarding regulatory reform efforts, the SEC and CFTC are jointly reviewing how to harmonize their approaches to market regulation and are expected to publish a report on October 15th. One of the points that will be studied is "National market and common clearing versus separate markets and exchange-directed clearing."

Sources: EIA (http://www.eia.doe.gov/oil_gas/petroleum/data_publications/weekly_petroleum_status_report/wpsr.html), SEC (http://www.sec.gov/news/press/2009/2009-211.htm)

Thursday, September 24, 2009

Distillate Fuel inventories in the U.S. continue to climb

The U.S. Energy Information Agency weekly statistics published yesterday morning included an unexpected 3 million barrel increase in U.S. distillate fuel inventories, pushing NYMEX Heating Oil futures down $0.05 for October and November 2009 delivery.

(Source: U.S. EIA, http://tonto.eia.doe.gov/dnav/pet/hist/wdistus1w.htm)

Tuesday, September 22, 2009

Markets Update, Singapore Fuel Oil 180cst Hedging and Trading

It was no surprise to see crude prices rebound yesterday, following the pattern of the last few months of a tightening, range bound market. The major western crude benchmarks are increasingly squeezing the $70 price point while Singapore Fuel Oil prices ping back and forth between $410 and $450.

Most analysts point to the weak US Dollar which yesterday fell short of key resistance levels vs a basket of major currencies. We feel that so long as global economic data continues to trend positive, the Dollar will experience further selling pressure which will not necessarily impact crude prices to the same extend as we’ve seen since mid-March. Rather, the overwhelming excess supply (Saudi Arabia’s spare capacity, OPEC member and non-member flooding of the market) paired with weak global demand (excess refining capacity, weak industrial demand- China’s oil imports fell in August while diesel demand is dragging behind the country’s economic growth) will continue in the short-term to keep a lid on prices despite Dollar weakness.

Last week’s trade recommendation continues to work well- in effect if Oct09 and Nov09 Singapore FO 180cst settle below $450, the trader is rewarded with a free Dec09 $450 call. Given the market’s range bound trading as of late, this trade continues to be popular. It remains possible to put this trade on for Zero Premium (no premium at risk below $450 in Oct or Nov), but with October expiration fast approaching, the door for this trade is fast closing (which in this case implies its effectiveness and profitability is only increasing).

Singapore

Most analysts point to the weak US Dollar which yesterday fell short of key resistance levels vs a basket of major currencies. We feel that so long as global economic data continues to trend positive, the Dollar will experience further selling pressure which will not necessarily impact crude prices to the same extend as we’ve seen since mid-March. Rather, the overwhelming excess supply (Saudi Arabia’s spare capacity, OPEC member and non-member flooding of the market) paired with weak global demand (excess refining capacity, weak industrial demand- China’s oil imports fell in August while diesel demand is dragging behind the country’s economic growth) will continue in the short-term to keep a lid on prices despite Dollar weakness.

Last week’s trade recommendation continues to work well- in effect if Oct09 and Nov09 Singapore FO 180cst settle below $450, the trader is rewarded with a free Dec09 $450 call. Given the market’s range bound trading as of late, this trade continues to be popular. It remains possible to put this trade on for Zero Premium (no premium at risk below $450 in Oct or Nov), but with October expiration fast approaching, the door for this trade is fast closing (which in this case implies its effectiveness and profitability is only increasing).

Singapore

Thursday, September 17, 2009

Tuesday, September 15, 2009

Markets Update, Singapore Fuel Oil 180cst Hedging and Trading

Investor risk appetite pushed the major crude benchmarks back above/towards $70 while exerting downward pressure on the US Dollar. With the greenback now trading at levels not seen for a full year, many would expect to see crude prices continue pushing higher. This has not been the case however, as seasonal downturns in Western oil demand will continue to exert negative pressure for the next several months.

Several bullish items were the focal point of traders’ discussions on the Floor yesterday. OPEC raised its global oil demand forecasts for 2010 while amending higher the current year’s expected demand by 0.14M b/d. Meanwhile, US Fed Chairman Ben Bernanke was quoted as saying the US recession “is very likely over”. However it is important to pair this info with data showing enormous excess global spare capacity. A recent article by Simon Parry titled “Revealed: The Ghost Fleet of the Recession” making the rounds amongst traders has also resulted in much debate. The article is well worth reading and can be found by searching the title on Google.

Many traders expect neutral to weak price action through mid-Nov followed by a year-end push higher (due to the (foolish?) expectation of increased global demand eating into excess crude and product stocks). Traders can use simple option structures to protect against a December surge in prices while posting zero premium (no premium at risk below certain price levels). For example, using Singapore Fuel Oil 180cst, traders can sell the October and November $450/500 call spreads and use that premium received to pay for the December $450 call. This trade contains no risk if Oct and Nov settle below $450 and has maximum upside exposure of $50 per month in Oct and Nov. Similarly, if Oct and Nov expire below $450, the trader has just received a free December $450 call with unlimited upside reward potential.

Singapore

Several bullish items were the focal point of traders’ discussions on the Floor yesterday. OPEC raised its global oil demand forecasts for 2010 while amending higher the current year’s expected demand by 0.14M b/d. Meanwhile, US Fed Chairman Ben Bernanke was quoted as saying the US recession “is very likely over”. However it is important to pair this info with data showing enormous excess global spare capacity. A recent article by Simon Parry titled “Revealed: The Ghost Fleet of the Recession” making the rounds amongst traders has also resulted in much debate. The article is well worth reading and can be found by searching the title on Google.

Many traders expect neutral to weak price action through mid-Nov followed by a year-end push higher (due to the (foolish?) expectation of increased global demand eating into excess crude and product stocks). Traders can use simple option structures to protect against a December surge in prices while posting zero premium (no premium at risk below certain price levels). For example, using Singapore Fuel Oil 180cst, traders can sell the October and November $450/500 call spreads and use that premium received to pay for the December $450 call. This trade contains no risk if Oct and Nov settle below $450 and has maximum upside exposure of $50 per month in Oct and Nov. Similarly, if Oct and Nov expire below $450, the trader has just received a free December $450 call with unlimited upside reward potential.

Singapore

Weak petroleum demand / Bullish markets

We note the API inventory data is again showing a large build in distillates (5.2 MN bbls).

Weak demand fundamentals in the US and Europe have driven petroleum cracks down to 12 month lows, forcing refiners to examine operating rates and length of planned turnarounds. High inventories have to be corrected at some point. Unless home heating demand is above average, we will need to see demand pick up in the rail, road diesel, aviation or maritime sectors to see a rebound in crack levels. Meantime, there is an opportunity to use NY heating oil or European gasoil options to hedge upside petroleum exposure in both crude and refining cracks.

Using the NY Heating Oil options (Asian) for a consumer hedge, the Q1 $2.00-2.50 call spread is offered at $0.1250/gallon. Adding a sale of the $1.70 put creates a structured 3-way option strategy for "zero" premium cost.

Please email or call to be added to the consumer hedge tear sheet blast.

New York, Sept 15.

Weak demand fundamentals in the US and Europe have driven petroleum cracks down to 12 month lows, forcing refiners to examine operating rates and length of planned turnarounds. High inventories have to be corrected at some point. Unless home heating demand is above average, we will need to see demand pick up in the rail, road diesel, aviation or maritime sectors to see a rebound in crack levels. Meantime, there is an opportunity to use NY heating oil or European gasoil options to hedge upside petroleum exposure in both crude and refining cracks.

Using the NY Heating Oil options (Asian) for a consumer hedge, the Q1 $2.00-2.50 call spread is offered at $0.1250/gallon. Adding a sale of the $1.70 put creates a structured 3-way option strategy for "zero" premium cost.

Please email or call to be added to the consumer hedge tear sheet blast.

New York, Sept 15.

Labels:

Distillate

Tuesday, September 1, 2009

September Bearish Pressure; Singapore Fuel Oil 180cst

The long-expected correction in crude and equity markets (can anyone tell the difference between the two these days?) appears to have begun this week. This despite relatively positive economic data permeating from across the globe- most recently positive ISM manufacturing data released in the US. The issue appears to be too much of a run-up too fast, as the pressure from a historically weak September and October bears down on investors and traders.

Much of the current fear from traders this week can be traced to indications from the Chinese government of a curb in bank lending. On the surface, this can be expected to result in lower energy demand across the board and in the words of Australian Treasurer Wayne Swan, a potential “knee-capping” of the economic recovery seen since March.

If bearish sentiment continues, expect to see a potential break below support levels in WTI around $67.35. Further declines in shipping rates due to reduced Chinese demand can be expected to continue, as reported in a Bloomberg survey earlier in the week highlighting expectations for a 50% drop in freight rates in the next 4 months.

Despite the approximately 10% rise in bunker prices last month and strong price support exhibited recently at ports globally (relative to WTI & Brent), inventory holders worried about short-term protection should not take bunker price strength for granted. A $420 price floor in October Singapore Fuel Oil 180cst can be locked-in for zero cost by accepting a price ceiling in the same month around $445. Similarly, suppliers holding inventory may wish to simply sell an upside price ceiling around the $480 level for around $15/MT. This type of hedge gives $15 of downside price protection while ensuring a payment of at most $15/MT upon an October expiration below $495.

Singapore, 08:00

Much of the current fear from traders this week can be traced to indications from the Chinese government of a curb in bank lending. On the surface, this can be expected to result in lower energy demand across the board and in the words of Australian Treasurer Wayne Swan, a potential “knee-capping” of the economic recovery seen since March.

If bearish sentiment continues, expect to see a potential break below support levels in WTI around $67.35. Further declines in shipping rates due to reduced Chinese demand can be expected to continue, as reported in a Bloomberg survey earlier in the week highlighting expectations for a 50% drop in freight rates in the next 4 months.

Despite the approximately 10% rise in bunker prices last month and strong price support exhibited recently at ports globally (relative to WTI & Brent), inventory holders worried about short-term protection should not take bunker price strength for granted. A $420 price floor in October Singapore Fuel Oil 180cst can be locked-in for zero cost by accepting a price ceiling in the same month around $445. Similarly, suppliers holding inventory may wish to simply sell an upside price ceiling around the $480 level for around $15/MT. This type of hedge gives $15 of downside price protection while ensuring a payment of at most $15/MT upon an October expiration below $495.

Singapore, 08:00

Tuesday, August 18, 2009

Return to the $70 Pivot, Bunker Hedging Strategies

The $70 pivot in WTI crude proved too much of a magnet for the bears yesterday, as the October crude benchmark now stands firmly above $71. Dollar weakness on the back of encouraging European and Japanese economic data pushed equities and thus the asset class that we now know as crude oil higher. Nevertheless, the short-term focus remains on the US EIA data and whether or not the API’s shocking inventory draws will be matched.

The strong rally in Fuel Oil prices can be expected to continue for the foreseeable future as refinery run cuts and relatively strong bunker demand look to persist. By accepting a leveraged price floor in Singapore Fuel Oil 180cst at $380 (more than $50 below current levels), bunker consumers can gain a Zero Cost price ceiling at $450 (less than $20 above current levels) for the entirety of Q409. Similarly, by utilizing a limited price ceiling (protection from $450 to $500) consumers willing to accept the leveraged price floor at $380 can actually receive approximately $20/MT of premium reimbursements each month of Q409 so long as Sing FO 180cst settles above $380.

Singapore

The strong rally in Fuel Oil prices can be expected to continue for the foreseeable future as refinery run cuts and relatively strong bunker demand look to persist. By accepting a leveraged price floor in Singapore Fuel Oil 180cst at $380 (more than $50 below current levels), bunker consumers can gain a Zero Cost price ceiling at $450 (less than $20 above current levels) for the entirety of Q409. Similarly, by utilizing a limited price ceiling (protection from $450 to $500) consumers willing to accept the leveraged price floor at $380 can actually receive approximately $20/MT of premium reimbursements each month of Q409 so long as Sing FO 180cst settles above $380.

Singapore

Tuesday, August 11, 2009

Crude Markets Retrench; Singapore Fuel Oil 180cst Hedging

A stronger US Dollar finally brought the crude markets lower yesterday, pulling WTI crude below the psychological $70 support level and outside of its recent $70-72 trading range. Despite the wide gap between WTI and Brent (just under -$3.00), the spread between the two major benchmarks remained mostly unchanged during yesterday’s fall. For those watching the price of crude on a day to day basis, the US Dollar and equities (investor sentiment) remain the chief catalysts for moving the market.

Traders should remain wary of recently surfacing short-term bearish sentiment in crude markets (not only from investor sentiment but also as a result of the latest negative comments emanating from OPEC re oversupply of refined products and subsequent effects on feedstock demand). Plenty of time still remains in the Atlantic hurricane season and meteorologists are closely watching a storm cluster recently formed off the coast of West Africa. Given past encounters between oil producers/refiners and hurricanes in the Gulf of Mexico, ignoring the possibility of a price spike in the next few months can certainly prove costly.

Much to the chagrin of shipping companies around the world, bunker fuel prices remain firm despite recent weakness in major Western benchmarks. Therefore consumer hedging remains a major factor in controlling one’s fuel costs. Establishing a price ceiling in Q409 through 1H10 in Singapore Fuel Oil 180cst at $450 for Zero Cost is possible by accepting a leveraged price floor in the same tenor at around $380. Similarly, for those seeking a non-leveraged position, the $450/550 call spread in each of the 9 months beginning with Oct09 can be owned for Zero Cost by accepting a price floor around $390 in the same tenor. This hedge provides $100 of consumer protection per month in Q409 through 1H10 with no hedging losses at or above $390.

Singapore

Traders should remain wary of recently surfacing short-term bearish sentiment in crude markets (not only from investor sentiment but also as a result of the latest negative comments emanating from OPEC re oversupply of refined products and subsequent effects on feedstock demand). Plenty of time still remains in the Atlantic hurricane season and meteorologists are closely watching a storm cluster recently formed off the coast of West Africa. Given past encounters between oil producers/refiners and hurricanes in the Gulf of Mexico, ignoring the possibility of a price spike in the next few months can certainly prove costly.

Much to the chagrin of shipping companies around the world, bunker fuel prices remain firm despite recent weakness in major Western benchmarks. Therefore consumer hedging remains a major factor in controlling one’s fuel costs. Establishing a price ceiling in Q409 through 1H10 in Singapore Fuel Oil 180cst at $450 for Zero Cost is possible by accepting a leveraged price floor in the same tenor at around $380. Similarly, for those seeking a non-leveraged position, the $450/550 call spread in each of the 9 months beginning with Oct09 can be owned for Zero Cost by accepting a price floor around $390 in the same tenor. This hedge provides $100 of consumer protection per month in Q409 through 1H10 with no hedging losses at or above $390.

Singapore

Monday, August 10, 2009

Friday, August 7, 2009

Record levels of U.S. distillate fuel exports

The U.S. Energy Information Agency reports that monthly U.S. exports of distillate fuel are at record levels, driven partially by unusually high U.S. distillate fuel inventories.

Thursday, August 6, 2009

Tuesday, August 4, 2009

Oil Continues Higher, Singapore Fuel Oil 180cst Hedging

Energy markets took a breather yesterday during what appears to be a relentless march higher. Months, if not several quarters ahead of any significant return to demand, the current rally in the major crude benchmarks WTI and Brent has everything to do with a renewed demand for relatively riskier assets. This translates to day-to-day trading activity focusing almost exclusively on broader investment trends. The United States EIA inventory numbers due out tonight are expected to take a somewhat neutral tone, thus any surprise draws would give further impetus to the underlying rally, while builds may simply continue to be ignored.

Consumer hedgers (of any product) may wish to keep an eye on both WTI and Brent as the $75 level looks to be broken shortly. Twice we have bounced off this number in recent months as fears of the high price of crude derailing any nascent recovery begin to take hold.

Bunker prices continue to march higher on the back of increasing demand and refinery cuts, thus adding significant pain to shipping companies across the globe. Hedging strategies which utilize only swaps work best when a market simply moves in one direction. As the Western benchmarks approach $75 and another pull-back becomes possible, consumer hedgers can use options to take advantage of price swings lower while maintaining some measure of protection on the upside. The Singapore Fuel Oil 180cst Q409 $450/mt price ceiling (call option) can be owned for zero premium by accepting a price floor around $425. In order to reap the benefits of a possible (but not wholly likely) downward move in fuel prices in the final quarter of the year, hedgers can own the $450/500 call spread for zero premium by accepting a price floor at $375. This trade allows consumers to enjoy a healthy price drop of more than $60 before hedging losses begin while also providing $50 of protection per month above $450.

Singapore

Consumer hedgers (of any product) may wish to keep an eye on both WTI and Brent as the $75 level looks to be broken shortly. Twice we have bounced off this number in recent months as fears of the high price of crude derailing any nascent recovery begin to take hold.

Bunker prices continue to march higher on the back of increasing demand and refinery cuts, thus adding significant pain to shipping companies across the globe. Hedging strategies which utilize only swaps work best when a market simply moves in one direction. As the Western benchmarks approach $75 and another pull-back becomes possible, consumer hedgers can use options to take advantage of price swings lower while maintaining some measure of protection on the upside. The Singapore Fuel Oil 180cst Q409 $450/mt price ceiling (call option) can be owned for zero premium by accepting a price floor around $425. In order to reap the benefits of a possible (but not wholly likely) downward move in fuel prices in the final quarter of the year, hedgers can own the $450/500 call spread for zero premium by accepting a price floor at $375. This trade allows consumers to enjoy a healthy price drop of more than $60 before hedging losses begin while also providing $50 of protection per month above $450.

Singapore

Thursday, July 30, 2009

Tuesday, July 28, 2009

Singapore Fuel Oil Remains Firm

Energy markets began to pull back on Tuesday as traders question the legitimacy of the recent commodity/equity rally. The US Dollar certainly looks oversold at this stage and it wouldn’t be surprising to see a greenback rally force crude prices lower through the month of August. Yesterday’s trading in the western benchmark crudes displayed significant technical weakness while demand for black gold is expected to remain weak throughout the third quarter. However, there are several factors that could easily lead to one more price spike before the market pares back its gains: weak July/Aug trading volumes paired with the ever-present threat from hurricane season in the Gulf of Mexico remain an underlying bullish threat.

Mirroring equity markets, most commodities have pushed over or near highs for 2009 mainly on the back of anaemic fundamentals. That is with the exception of bunker fuel, much to the chagrin of tanker operators and other consumers of the crude by-product. Much has been written as of late regarding Fuel Oil’s recent rally- actually with some fundamental backing to it (refinery upgrades and producer cuts of heavy, sour crude lead many traders to believe bunker prices will continue to power upwards for the foreseeable future).

With this level of uncertainty in the market, it would benefit bunker consumers to hedge a portion of their fuel needs both in the swaps and options markets. Aside from positioning themselves to lock-in future prices at today’s levels by buying swaps, costless collars and similar structures provide some downside advantages while also providing full upside price protection above a certain price. For example, in Singapore Fuel Oil 180cst, unlimited upside protection above $450 can be owned in Sept through December ’09 by accepting a price floor at $390. Similarly, consumer protection between $450 and $500 can be had by accepting a much lower price floor of around $355. This strategy currently avails the consumer of approximately $60 of downside price movement paired with $50 of protection above $450.

Singapore

Mirroring equity markets, most commodities have pushed over or near highs for 2009 mainly on the back of anaemic fundamentals. That is with the exception of bunker fuel, much to the chagrin of tanker operators and other consumers of the crude by-product. Much has been written as of late regarding Fuel Oil’s recent rally- actually with some fundamental backing to it (refinery upgrades and producer cuts of heavy, sour crude lead many traders to believe bunker prices will continue to power upwards for the foreseeable future).

With this level of uncertainty in the market, it would benefit bunker consumers to hedge a portion of their fuel needs both in the swaps and options markets. Aside from positioning themselves to lock-in future prices at today’s levels by buying swaps, costless collars and similar structures provide some downside advantages while also providing full upside price protection above a certain price. For example, in Singapore Fuel Oil 180cst, unlimited upside protection above $450 can be owned in Sept through December ’09 by accepting a price floor at $390. Similarly, consumer protection between $450 and $500 can be had by accepting a much lower price floor of around $355. This strategy currently avails the consumer of approximately $60 of downside price movement paired with $50 of protection above $450.

Singapore

Wednesday, July 22, 2009

Trading Ranges, Singapore Fuel Oil Consumer Hedging

Crude prices remain mired in the $64 – 66 range despite Department of Energy inventory figures showing a draw of 1.8m bbls. The figure was largely in line with traders’ expectations, but conflicted sharply with that of Tuesday’s API report showing a build in crude stocks. The numbers in the DOE report were largely the result of a slight decrease in crude runs paired with drooping imports. Despite seven weeks of crude inventory draws, US stocks remain significantly above levels from the previous year.

July and August typically exhibit a moribund trading pattern with decreasing volumes but leaning more to the bullish side. Commodity traders expecting equity markets to pull crude prices higher may have to wait until holiday season is over, as both markets have experienced recent rallies and appear to have entered a holding pattern.

Bunker consumers seeking cheap but effective upside protection in the 4th Quarter of the year can look to a Singapore 180cst Fuel Oil costless 3-way structure. The Q409 $425 / 475 call spread can be owned for zero cost by accepting a price floor at $345. This hedge allows for $50 of upside protection per month above $425 with no premium at risk above the $345 level. With the Q409 underlying trading just under $400 and implied vol in the mid-40’s, the $345 price floor is almost 5 standard deviations to the downside and a level not broken below since $350 became a solid price floor two months ago. Regardless, the hedge allows for more than $50 of downside price movement (good for the consumer) with $50 of upside protection above $425 with no premium at risk upon settlement at or above $345.

Singapore

July and August typically exhibit a moribund trading pattern with decreasing volumes but leaning more to the bullish side. Commodity traders expecting equity markets to pull crude prices higher may have to wait until holiday season is over, as both markets have experienced recent rallies and appear to have entered a holding pattern.

Bunker consumers seeking cheap but effective upside protection in the 4th Quarter of the year can look to a Singapore 180cst Fuel Oil costless 3-way structure. The Q409 $425 / 475 call spread can be owned for zero cost by accepting a price floor at $345. This hedge allows for $50 of upside protection per month above $425 with no premium at risk above the $345 level. With the Q409 underlying trading just under $400 and implied vol in the mid-40’s, the $345 price floor is almost 5 standard deviations to the downside and a level not broken below since $350 became a solid price floor two months ago. Regardless, the hedge allows for more than $50 of downside price movement (good for the consumer) with $50 of upside protection above $425 with no premium at risk upon settlement at or above $345.

Singapore

Friday, July 17, 2009

Wednesday, July 15, 2009

ETFs swing size to Natural Gas

Investor interest has moved sharply away from front crude ETFs to natural gas. This phenomenon has potentially given support to natural gas futures despite bearish fundamentals.

Thursday, July 2, 2009

Tuesday, June 23, 2009

Consolidation Continues; Singapore Fuel Oil Trading

Crude markets moved higher yesterday on the back of a weaker US dollar and renewed economic optimism (both ArcelorMittal and Posco announced steel production increases owing to greater demand). The front-month WTI contract had fallen approximately 10% since last week before regaining some composure and ending a 5-day losing skid. It should be noted that as of 9am in Singapore, front-month WTI is down once again more than $1.00. Surprisingly, the unleaded gasoline crack did not lead the way higher (as had been the case for the recent 2-month rally) as stocks of that product showed another weekly build according to API data. Expect the Western benchmark feedstock contracts (WTI & Brent) to continue to trade as an asset class at least in the short-term, mimicking equities and moving inversely to the US dollar while ignoring near-term supply overhangs and lingering geopolitical issues.

Asian Fuel Oil prices will continue to ape those of the broader energy complex. Thus, while the Singapore Fuel Oil 180cst swap may not exhibit much of a trend in early trading, the contract will certainly be to a large extent beholden to trends in the heavily traded Western contracts, despite the selling pressure from refiners the previous week. The WTI and Brent rally should prove short-lived as the market continues to exhibit consolidation signals and yesterday’s price action was only a reinforcement of this thesis. Traders looking to short near-term implied volatility in the Fuel Oil market may be interested in the August09 Sing FO 180 $350/425 strangle (selling a price floor and ceiling) at around $25.00/MT. Upon expiration, this trade yields $25,000/1000MT between $350 and 425, with breakeven at $325 and $450. Below $350 the trader is long from that price and above $425 short from that level.

Singapore

Asian Fuel Oil prices will continue to ape those of the broader energy complex. Thus, while the Singapore Fuel Oil 180cst swap may not exhibit much of a trend in early trading, the contract will certainly be to a large extent beholden to trends in the heavily traded Western contracts, despite the selling pressure from refiners the previous week. The WTI and Brent rally should prove short-lived as the market continues to exhibit consolidation signals and yesterday’s price action was only a reinforcement of this thesis. Traders looking to short near-term implied volatility in the Fuel Oil market may be interested in the August09 Sing FO 180 $350/425 strangle (selling a price floor and ceiling) at around $25.00/MT. Upon expiration, this trade yields $25,000/1000MT between $350 and 425, with breakeven at $325 and $450. Below $350 the trader is long from that price and above $425 short from that level.

Singapore

Sunday, June 21, 2009

Geo-Politics and Consolidation

Energy markets ended last week on a soft note, however upward momentum remains in place. Bullish World Bank forecasts for Chinese GDP growth along with a reported increase in American motor-vehicle travel (the first year-on-year increase in almost 1.5 years)will provide further ammunition for the “green shoots” argument. Geo-political issues appear to be rearing their ugly head after many months of relative calm from the production side. Renewed attacks on Nigerian pipelines, civil unrest in Iran and reports of a US Navy Destroyer tracking a N Korean vessel have had limited impact on crude prices at this point.

Crude prices gave up much of the gains for the week on the back of poor price action in the gasoline complex on Friday. Weak US equities as well as bearish US inventory data earlier in the week helped pull front-month Unleaded below $2.00. The sharp drop in prices was due in part to expiration-day crack spread trading, which involves traders rolling out of the July contract and into August. As mentioned, however, the overall positive price momentum remains in place on the back of optimistic economic and investor sentiment.

Tracking crude and product prices for the past several weeks reveals an obvious consolidation pattern- similar to that seen in most equity indices. Many traders have begun to position themselves for a possible retracement lower, either by buying downside put options or simply taking profits on long swap positions. In fact, the CFTC reported that last week net speculative longs actually dropped more than 20% to just above 92,000 contracts. Traders looking to take advantage of the recent consolidation phase by selling implied volatility can look to sell the Brent APO August $65/75 strangle at around $5.00/bbl ($5,000 of premium per 1000 barrels with breakeven at $60 or $80 upon expiration).

Singapore

Crude prices gave up much of the gains for the week on the back of poor price action in the gasoline complex on Friday. Weak US equities as well as bearish US inventory data earlier in the week helped pull front-month Unleaded below $2.00. The sharp drop in prices was due in part to expiration-day crack spread trading, which involves traders rolling out of the July contract and into August. As mentioned, however, the overall positive price momentum remains in place on the back of optimistic economic and investor sentiment.

Tracking crude and product prices for the past several weeks reveals an obvious consolidation pattern- similar to that seen in most equity indices. Many traders have begun to position themselves for a possible retracement lower, either by buying downside put options or simply taking profits on long swap positions. In fact, the CFTC reported that last week net speculative longs actually dropped more than 20% to just above 92,000 contracts. Traders looking to take advantage of the recent consolidation phase by selling implied volatility can look to sell the Brent APO August $65/75 strangle at around $5.00/bbl ($5,000 of premium per 1000 barrels with breakeven at $60 or $80 upon expiration).

Singapore

Thursday, June 18, 2009

Obama proposal suggests all OTC derivatives to clear on exchange

Excerpt from Obama proposal issued June 17, 2009

"To contain systemic risks, the Commodities Exchange Act (CEA) and the securities laws

should be amended to require clearing of all standardized OTC derivatives through

regulated central counterparties (CCPs). To make these measures effective, regulators

will need to require that CCPs impose robust margin requirements as well as other

necessary risk controls and that customized OTC derivatives are not used solely as a

means to avoid using a CCP. For example, if an OTC derivative is accepted for clearing

by one or more fully regulated CCPs, it should create a presumption that it is a

standardized contract and thus required to be cleared."

http://www.financialstability.gov/docs/regs/FinalReport_web.pdf

"To contain systemic risks, the Commodities Exchange Act (CEA) and the securities laws

should be amended to require clearing of all standardized OTC derivatives through

regulated central counterparties (CCPs). To make these measures effective, regulators

will need to require that CCPs impose robust margin requirements as well as other

necessary risk controls and that customized OTC derivatives are not used solely as a

means to avoid using a CCP. For example, if an OTC derivative is accepted for clearing

by one or more fully regulated CCPs, it should create a presumption that it is a

standardized contract and thus required to be cleared."

http://www.financialstability.gov/docs/regs/FinalReport_web.pdf

Tuesday, June 16, 2009

Singapore Fuel Oil Hedging

The weakening trend begun early Monday is expected to continue into Asian trading today. Crude appears to have found both support and resistance levels firmly within $2 of $70, while price action in Singapore Fuel Oil 180cst should look quite similar. Unable to break through and settle consistently above the psychological $400 mark, energy markets including Sing FO look to be taking a breather. It is specifically this type of consolidation which will allow for further moves higher. The danger being, of course, of a slow grind lower where WTI and Brent break through support levels on their way back to a 5-handle (pricing in the $50 range) with Fuel Oil exhibiting similar short-term weakness and trending below $300. However, even with considerable Western-benchmark weakness, Fuel Oil cracks may remain strong as a result of Opec production cuts (which consist predominantly of the heavy-sour crude).

Consumer hedgers looking to protect against Sing FO 180 pushing above $400 can also use hedging to profit from a Brent weakening (and thus a further narrowing of the price differential between light, sweeter crude and heavy-sour crude). The August09 Sing FO 180 $410/460 call spread can be owned for only $3.00/MT when the $350 put is sold. Similarly, the August09 Brent $55/65 put spread can be owned for zero cost by selling the $79 call for financing. This type of trade positions the consumer hedger to profit from a narrowing of the sweet-sour spread. It also functions to provide protection against a strengthening of bunker fuel as a result of production and refining fundamentals vs a weakening of Brent/WTI due to a slowing of investment flows.

Singapore, 09:00

Consumer hedgers looking to protect against Sing FO 180 pushing above $400 can also use hedging to profit from a Brent weakening (and thus a further narrowing of the price differential between light, sweeter crude and heavy-sour crude). The August09 Sing FO 180 $410/460 call spread can be owned for only $3.00/MT when the $350 put is sold. Similarly, the August09 Brent $55/65 put spread can be owned for zero cost by selling the $79 call for financing. This type of trade positions the consumer hedger to profit from a narrowing of the sweet-sour spread. It also functions to provide protection against a strengthening of bunker fuel as a result of production and refining fundamentals vs a weakening of Brent/WTI due to a slowing of investment flows.

Singapore, 09:00

Sunday, June 14, 2009

Expectations for $75

Energy markets gained fresh legs last week from a number of positive economic indicators enabling both WTI and Brent to settle firmly above the $70 level. The end of the week saw Chinese retail sales and factory output increasing substantially while the EIA released surprisingly bullish inventory data. The IEA added to the bullish trend by issuing a forecast for a rise in crude demand on the back of an expected increase in energy consumption in the US and China. While these numbers can certainly be viewed as optimistic in the short-term, it remains to be seen whether there is significant underlying strength (post-stimulus) in this economic recovery, particularly in regard to China’s private sector demand.

Expectations for this week center on the push by WTI and Brent to break through near-term resistance around the $75.85 level. Otherwise, expect a slow and painful drift lower. The fact remains that funds and various speculators have been piling into the market as of late (last week crude longs increased 3.5% to 206,000 while speculative longs surged more than 7% to 118,000 contracts according to the CFTC) and thus there is enormous paper length invested in a further move higher. From a psychological perspective, the more we rise the more those who missed most of the “fun” will feel pressure to jump in now and not miss any more of it. Expect significant upward pressure to continue.

Monday morning begins with market participants digesting bullish news of incumbent Ahmadinejad’s re-election victory in Iran. Given the lack of a significant retracement since bouncing off $66, many consumer hedgers and traders are reluctant to simply purchase swaps to protect/profit from further moves higher. Instead, call spreads and call spreads partially financed by put sales are more in demand. For instance, the Brent APO August $80/90 call spread can be owned for only about $1.75 ($8,250 possible payout vs only $1,750 of risk). Similarly, the Brent APO December09 $85/110 call spread can be owned for only $1,500/1000bbls when the $61.50 put is shorted to provide financing.

Singapore

Expectations for this week center on the push by WTI and Brent to break through near-term resistance around the $75.85 level. Otherwise, expect a slow and painful drift lower. The fact remains that funds and various speculators have been piling into the market as of late (last week crude longs increased 3.5% to 206,000 while speculative longs surged more than 7% to 118,000 contracts according to the CFTC) and thus there is enormous paper length invested in a further move higher. From a psychological perspective, the more we rise the more those who missed most of the “fun” will feel pressure to jump in now and not miss any more of it. Expect significant upward pressure to continue.

Monday morning begins with market participants digesting bullish news of incumbent Ahmadinejad’s re-election victory in Iran. Given the lack of a significant retracement since bouncing off $66, many consumer hedgers and traders are reluctant to simply purchase swaps to protect/profit from further moves higher. Instead, call spreads and call spreads partially financed by put sales are more in demand. For instance, the Brent APO August $80/90 call spread can be owned for only about $1.75 ($8,250 possible payout vs only $1,750 of risk). Similarly, the Brent APO December09 $85/110 call spread can be owned for only $1,500/1000bbls when the $61.50 put is shorted to provide financing.

Singapore

Tuesday, June 9, 2009

Crude Above $70; Singapore Fuel Oil 180cst Hedging/Trading

As predicted, crude surged above $70 early in the week before the market had a chance to succumb to weak longs and profit taking around the $68 level. Bullish US API data including a crude draw of almost 6M bbls only served to pull more longs into the energy complex. It also doesn’t hurt that the Dollar appears to have resumed its downward trajectory, falling 1% against the Yen and Euro and almost 1.5% against the Pound.

WTI settlement after NY trading yesterday above $70 was key to the move higher and any EIA reinforcement tonight of the already released API inventory data will serve to underpin $70 as support. Part of the reason for the crude draw was feedstock inventories pulled through by refiners to take advantage of profitable crack spreads. While the Singapore Fuel Oil 180cst crack may not strengthen much more in the short-term, it is expected to hold around its current level and thus the underlying should rise in parallel with WTI and Brent. As with $70 in the western benchmarks, expect the $400 level (if broken and settled above in July in the next 48 hours) to become psychological support for further moves higher.

Consumer hedgers/traders seeking to position themselves against a short-term push higher can look to own the Singapore FO 180 July09 $420 Call for zero cost by selling two $375 Calls in the same tenor. Similarly, the $450/500 call spread can be owned for zero cost by accepting a single price floor at $370.

Singapore

WTI settlement after NY trading yesterday above $70 was key to the move higher and any EIA reinforcement tonight of the already released API inventory data will serve to underpin $70 as support. Part of the reason for the crude draw was feedstock inventories pulled through by refiners to take advantage of profitable crack spreads. While the Singapore Fuel Oil 180cst crack may not strengthen much more in the short-term, it is expected to hold around its current level and thus the underlying should rise in parallel with WTI and Brent. As with $70 in the western benchmarks, expect the $400 level (if broken and settled above in July in the next 48 hours) to become psychological support for further moves higher.

Consumer hedgers/traders seeking to position themselves against a short-term push higher can look to own the Singapore FO 180 July09 $420 Call for zero cost by selling two $375 Calls in the same tenor. Similarly, the $450/500 call spread can be owned for zero cost by accepting a single price floor at $370.

Singapore

Sunday, June 7, 2009

Implied Vol Increases; Brent Vol Strategies

Energy markets gained fresh legs off last week’s rally from the Wednesday lows. The main catalyst for the price strength was job losses in the US slowing remarkably while the unemployment rate continued inching closer to 10%. Despite the often volatile trading, both WTI and Brent ended the week more than $2 higher than the preceding week and only about $0.40 lower on the day. Expect continued strength in the crude markets so long as the less-than-terrible economic news continues to flow and the Fund assault on $70 persists. This (psychological) level needs to be tested and broken immediately or else WTI and Brent will find themselves drifting back down to retest $65.50.

The steadily increasing yield on US Treasuries is not yet a major cause for concern as this remains an important indicator of economic activity returning to some level of normality. The 10-Year yield remains under 4%, not particularly alarming from a historic point of view, however the upward trend can be viewed as possibly an early alarm bell in debt markets signaling future trouble with capital raising (a la Latvia).

Implied volatility levels increased substantially across the energy complex after crude broke through and then retreated below the $70 level. As mentioned, an immediate assault on this price point needs to be launched again to prevent languishing around $66 for the next week. Brent traders looking to take advantage of the recent pop in implied vol to collect relatively high premiums can sell the Brent APO Aug09 $60 puts for around $1.00/bbl or perhaps the July09 $65 puts for approx $1.60/bbl. Traders looking for the market to remain rangebound between $65-72 may consider selling the Brent APO July09 $65/75 strangle for $3.20/bbl.

Singapore

The steadily increasing yield on US Treasuries is not yet a major cause for concern as this remains an important indicator of economic activity returning to some level of normality. The 10-Year yield remains under 4%, not particularly alarming from a historic point of view, however the upward trend can be viewed as possibly an early alarm bell in debt markets signaling future trouble with capital raising (a la Latvia).

Implied volatility levels increased substantially across the energy complex after crude broke through and then retreated below the $70 level. As mentioned, an immediate assault on this price point needs to be launched again to prevent languishing around $66 for the next week. Brent traders looking to take advantage of the recent pop in implied vol to collect relatively high premiums can sell the Brent APO Aug09 $60 puts for around $1.00/bbl or perhaps the July09 $65 puts for approx $1.60/bbl. Traders looking for the market to remain rangebound between $65-72 may consider selling the Brent APO July09 $65/75 strangle for $3.20/bbl.

Singapore

Thursday, June 4, 2009

Fresh Legs for Energy; Brent Crude Collar

Just as predicted, fund buying returned to the market yesterday and resumed the push to $70 in Brent and WTI benchmark crude. Support held firm around the $65.50 area and paper length saw Wednesday for what it was: an excellent buying opportunity, pushing July WTI to a 2009 high of $69.60. It didn’t hurt that GS yesterday introduced a newly minted bullish stance, both near- and long-term.

US unemployment data is due for release later today, and any surprise to the upside (read: not terrible news) should result in fresh paper buying. Psychological resistance will weed out some of the weak longs around $70, and a push above should bring us to the real ceiling around $71.85. Lastly, expect the typical Friday flattening up of short positions (as if we needed another reason unrelated to fundamentals to push higher).

Despite yesterday’s rally, implied volatility levels remain at Wednesday’s relatively inflated heights. Strong producer/hedger buying in the puts has resulted in the much talked about put skew- allowing for advantageous consumer collar buying. Traders looking for a near-term break above $70 can opt for the ICE Brent APO July09 $75 Call for zero cost by selling two $61 puts in the same tenor.

Singapore

US unemployment data is due for release later today, and any surprise to the upside (read: not terrible news) should result in fresh paper buying. Psychological resistance will weed out some of the weak longs around $70, and a push above should bring us to the real ceiling around $71.85. Lastly, expect the typical Friday flattening up of short positions (as if we needed another reason unrelated to fundamentals to push higher).

Despite yesterday’s rally, implied volatility levels remain at Wednesday’s relatively inflated heights. Strong producer/hedger buying in the puts has resulted in the much talked about put skew- allowing for advantageous consumer collar buying. Traders looking for a near-term break above $70 can opt for the ICE Brent APO July09 $75 Call for zero cost by selling two $61 puts in the same tenor.

Singapore

Tuesday, June 2, 2009

Energy Markets Re-trench; Singapore Fuel Oil Hedging/Trading

Energy markets traded without much direction yesterday as equities also looked undecided. Increasing fund flows have resulted in benchmark commodity contracts trading largely as an asset class (hedge against future inflation, hedge/trade against Dollar weakness) and with recent less-than-terrible economic news being reported (Chinese demand, ISM surveys) it appears there is too much long paper entering the market to call a top in energy futures. This also leads to the question as to whether the recent equity and commodity rally has over-compensated for the humble signs of recovery we have been observing. Basic energy supply and demand would tell us we have certainly gotten ahead of ourselves in the short-term, leading traders to not put much stock in the weekly US inventory data outside of the short spike in volatility seen immediately after the release of the numbers.

Despite yesterday’s lacklustre trading (and continuation of the implied vol implosion), the trend to the upside across the energy complex remains firmly intact. With recent IMF predictions of an 11% drop in world trade, one would expect bunker prices to remain mired near recent lows. This is not to be seen however, as Singapore Fuel Oil 180cst continues its assault on $400. As crude pushes for the inevitable break over $70, so FO follows to break through $400 and build support at that level. The current move higher began after breaking convincingly above $280, a price point briefly retested before the market pushed to today’s heady levels.

Consumer hedgers looking to protect against further near-term upside moves in bunker prices can own a zero-cost price ceiling in July Sing FO 180cst at $400 by also accepting a price floor at $370 leveraged twice. For those looking for limited downside risk, the July $420 price ceiling can be owned for zero cost by selling the $320/385 put spread in the same month. This hedge offers unlimited upside protection above $420 with $65 of risk on the downside.

Singapore

Despite yesterday’s lacklustre trading (and continuation of the implied vol implosion), the trend to the upside across the energy complex remains firmly intact. With recent IMF predictions of an 11% drop in world trade, one would expect bunker prices to remain mired near recent lows. This is not to be seen however, as Singapore Fuel Oil 180cst continues its assault on $400. As crude pushes for the inevitable break over $70, so FO follows to break through $400 and build support at that level. The current move higher began after breaking convincingly above $280, a price point briefly retested before the market pushed to today’s heady levels.

Consumer hedgers looking to protect against further near-term upside moves in bunker prices can own a zero-cost price ceiling in July Sing FO 180cst at $400 by also accepting a price floor at $370 leveraged twice. For those looking for limited downside risk, the July $420 price ceiling can be owned for zero cost by selling the $320/385 put spread in the same month. This hedge offers unlimited upside protection above $420 with $65 of risk on the downside.

Singapore

Sunday, May 31, 2009

Strong Asian Demand; ICE Brent Hedging/Trading

In the course of the last couple weeks we’ve seen several new highs for the year, and Friday was no exception. Closing out the week on the back of increasing pressure from the gasoline market, a spiralling (lower) dollar and a rally in equities, crude markets ended the month of May with gains of upwards of 30%. Economic data is the predominant catalyst pushing energy markets higher, and it is Asia that appears to be leading the charge in this respect. Industrial Production results for Asia during the month of April were surprisingly optimistic, highlighting the strength of the hoped for and much-discussed Asian recovery. This is no more apparent than in China where motor-vehicle sales and increased Ethylene production (related to Naptha demand) reveal a boosted oil demand picture.

After last week’s archetypal production meeting, Opec decided not to adjust announced output levels while also stating they expect higher near-term prices in the range of $75-80. According to the CFTC, crude longs increased by more than 9,000 contracts last week to 187k while speculative net longs also increased approximately 8% to 101.6k. On further moves higher, aside from psychological resistance at $70, expect significant selling pressure from profit-takers around $71.85.

Implied volatility has decreased substantially across the entire feedstock and product complex. Despite soft At-The-Money vols, the put skew remains elevated in crude markets, thus allowing consumer hedgers to own relatively better priced upside protection by selling inflated-priced puts for financing. For instance, the ICE Brent APO 2H09 $80 call can be owned for zero cost by selling the $57.50 put in the same tenor. Similarly, the ICE Brent APO 2H09 $80 call can be owned for zero cost when the $50/60.50 put spread is sold. This position results in unlimited upside protection/gains above $80 with only limited loss potential on the downside ($10.50/month).

Singapore

After last week’s archetypal production meeting, Opec decided not to adjust announced output levels while also stating they expect higher near-term prices in the range of $75-80. According to the CFTC, crude longs increased by more than 9,000 contracts last week to 187k while speculative net longs also increased approximately 8% to 101.6k. On further moves higher, aside from psychological resistance at $70, expect significant selling pressure from profit-takers around $71.85.

Implied volatility has decreased substantially across the entire feedstock and product complex. Despite soft At-The-Money vols, the put skew remains elevated in crude markets, thus allowing consumer hedgers to own relatively better priced upside protection by selling inflated-priced puts for financing. For instance, the ICE Brent APO 2H09 $80 call can be owned for zero cost by selling the $57.50 put in the same tenor. Similarly, the ICE Brent APO 2H09 $80 call can be owned for zero cost when the $50/60.50 put spread is sold. This position results in unlimited upside protection/gains above $80 with only limited loss potential on the downside ($10.50/month).

Singapore

Thursday, May 28, 2009

Opec Statement; Brent Hedging/Trading

Traders took their cue from Saudi Oil Minister Ali Naimi’s comments yesterday that the world economy is strong enough to endure $75-80 oil. The cartel’s de facto spokesperson provided fresh legs for what looks like the beginning stages of a push into the high $60’s for WTI and Brent. Look for resistance around $65.00 (mostly psychological), more specifically $64.85 and $65.20. Above these levels, look to scoop up some cheap puts around $67.12 as the market will encounter severe resistance at this point.

Energy markets may continue to ignore the enormous supply overhang in the short-term as inflationary pressures (manifest in rising long-term U.S. Treasury yields) have found a home in crude oil. Consumer hedgers and traders looking to be on-board for the next possible move higher can take advantage of the recently inflated put skew to finance the purchase of calls. For instance, the ICE Brent August09 $70 call can be owned for around $2.50/bbl or for zero premium by selling the $58 put in the same tenor. Similarly, the Brent December09 $70/85 call spread can be owned for zero cost by selling the $58.50 put.

Singapore

Energy markets may continue to ignore the enormous supply overhang in the short-term as inflationary pressures (manifest in rising long-term U.S. Treasury yields) have found a home in crude oil. Consumer hedgers and traders looking to be on-board for the next possible move higher can take advantage of the recently inflated put skew to finance the purchase of calls. For instance, the ICE Brent August09 $70 call can be owned for around $2.50/bbl or for zero premium by selling the $58 put in the same tenor. Similarly, the Brent December09 $70/85 call spread can be owned for zero cost by selling the $58.50 put.

Singapore

Tuesday, May 26, 2009

Rally gets Fresh Legs, Singapore Fuel Oil Hedging